The rise of in-car connectivity systems in recent years has seen virtually every new car come with some form of infotainment system.

No longer just a method of transport, many new models are now able to support functions like accessing the internet, and even actively learning about their drivers’ habits and preferences.

For example, Jaguar Land Rover is currently working on a “self-learning car”, which can monitor the lifestyle of its occupants and even predict their next move.

Thanks to new breakthroughs in artificial intelligence technology and recognition software, the car can recognise its drivers and passengers and remember personal preferences for seat adjustment, temperature and which type of music they like.

As well as that, it can also remember the driver’s unique driving style and automatically adjust its setup to reflect this. It can also schedule appointments in their calendars, giving prompts and reminders about everything from picking up shopping to going to the gym.

Jaguar Land Rover’s aim is to create a technology which offers the ultimate in driver distraction reduction: if the driver knows the car is taking care of everything else in their life, they can simply concentrate on the road ahead.

However, technology which actively gathers data and information about its users’ habits and lifestyle can also be of interest to other parties. Therefore, car manufacturers are already starting explore potentially selling off customers’ data for profit.

According to an article in the Telegraph by Andreas Gissler, managing director of automotive strategy at technology consultancy Accenture, carmakers are increasing connectivity-related services.

Features like Apple’s CarPlay, which supports Siri voice control, are already building up a pictures of users’ lifestyles, non-automotive industries are starting to seek ownership of the data in order to market directly towards buyers.

Cars already produce more data than any other piece of consumer equipment according to a report from American analysis firm McKinsey, and will produce even more of it in the future. Data can include everything from in-car phone usage to which locations drivers navigate to, or their choice of fuel stations.

Vehicle-specific data points could include fuel oil types, even going so far as to analyse performance and potential parts failures. Also, companies are starting to see some of their partners showing an interest in this information.

It’s no coincidence that Apple and Google have both committed themselves to building connected cars within the next few years, Gissler says, as the data produced could prove an invaluable goldmine.

The vast amounts of data that connected cars produce is only increasing, and by generating analytics-driven insights, both technology companies and car manufacturers themselves can start to generate new revenue streams.

Particularly from some luxury car brands there are already nascent steps in this direction. While Gissler acknowledges that the ability to turn data directly into revenue is still in its infancy, it’ll only get better over time.

Research from Accenture claims that the number of new cars that feature in-car connectivity systems will rise to 98 per cent by 2020, and five years after that every single new car sold will be connected.

Accenture’s estimates show that the data generated by in-car connectivity features could be worth nearly £4,000 in additional revenue for manufacturers over the lifespan of a vehicle. If this figure was applied to the number of vehicles sold in the UK last year, this would generate approximately £9.9 billion extra in profit.

The most valuable source of data for manufacturers, Gissler says, is data about how their products are used. Car makers will be able to identify trends by collecting location and usage data from drivers, which could complement or even altogether replace traditional market research.

Ultimately this could lead to better designed cars as manufacturers can build up a picture of exactly how users behave in their cars. However, it’s of utmost importance that any data stored in or collected by the car would be protected.

However, Accenture estimates that the greatest source of revenue will come from third parties, who will pay manufacturers a fee in order to directly access it. This could range from selling insurance products to a driver who’s recently had a crash, to generating insights for retailers as to where the best location is to build a new shop.

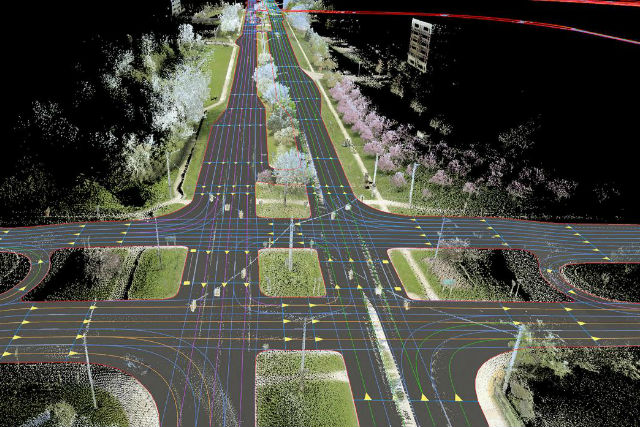

Gissler says that location-based data is particularly sought after, with a group of German manufacturers, among them BMW, Audi and Daimler, recently joint-acquiring mapping services company Here to help them build driverless cars.

Of course, this is a particularly exciting opportunity for car manufacturers, and although it might sound slightly scary, many companies – Google and Apple among them – already run their businesses based on data insights gathered from users.

For example, by tracking and saving all of your Google searches, Google can allow advertisers to target you with specific adverts tailored to things that you recently searched for. Also, falling iPad popularity has seen Apple increase its iPhone dimensions in response.

The trouble comes in maintaining control of the data gathered and in partnering with companies and providers that have the expertise necessary to keep up with consumers’ demands, evolving expectations and, most importantly, security needs.

Still, where there’s a will there’s a way, and where there’s a way there’s also a way to make money.