During the Autumn statement, Chancellor of the Exchequer Phillip announced new measures for Vehicle Excise Duty that will come into effect on April 1. Due to inflation, pricing for some cars could go up by as much as £65 per year – with age and levels of emissions affecting how much it will change.

Chancellor Hammond announced that this increase in VED will fund the upgrade and maintenance of England’s road network between 2020 and 2025 – with all the money raised ring-fenced exclusively for that purpose.

A further rise is expected in 2020 as well, but here is how drivers could be affected this Spring with tax increases.

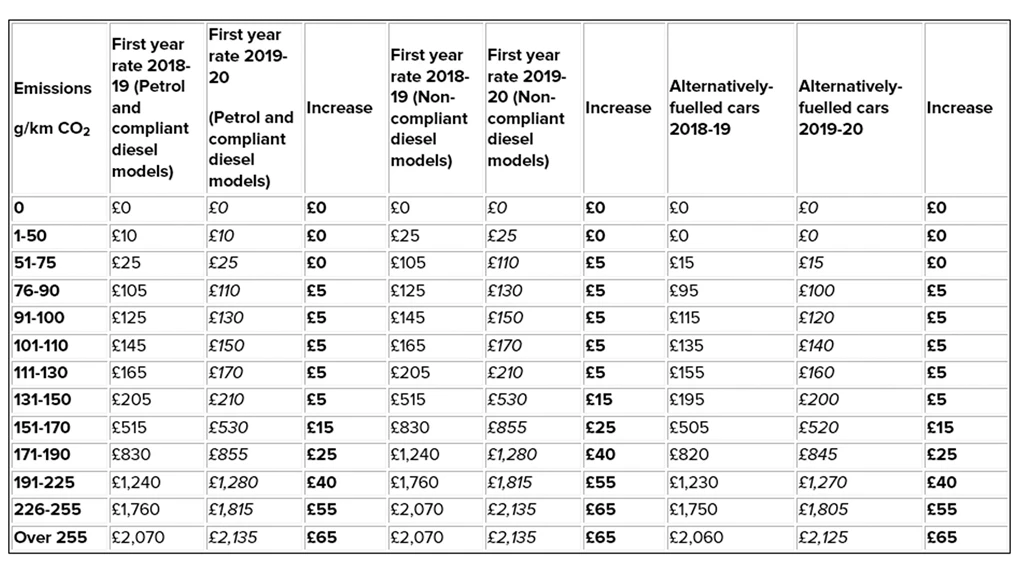

Cars bought from new after April 1, 2019, will see charges increased from between £5 and £65.

But as with the last set of VED prices, diesel models that don’t comply with the RDE2 emissions regulations will be placed a band higher. Alternatively-fuelled models will also get a £10 cut compared to the standard rate.

Click here to open the image in a new window

Following the first year of tax, the standard rate for petrol and diesel models will increase from £140 to £145, while the rate for AFVs will rise from £130 to £135.

Zero-emission vehicles will not get any rate hikes.

For vehicles registered between March 2001 and March 2017, the largest increase in annual charges will be £15 for vehicles emitting in excess of 226g/km CO2.

On cars between 121 and 175g/km CO2, the rate goes up by £5 – and for vehicles releasing between 176 and 225g/km CO2 charges go up by £10.

Vehicles with emissions up to 120g/km will not see any tax changes. You can search for your vehicle emissions data here.