LeasePlan, one of the largest leasing and fleet management companies in Europe has been sold to a group of investors for 3.7 billion euros, or around £2.59 billion.

The company first announced that its owners were in discussions over a sale back in March, however the news was officially confirmed by LeasePlan chief executive Vahid Daemi this morning.

In a statement, he said: “The change of ownership announced today marks a new era for our company and will enable LeasePlan to continue our successful journey and focus on executing our long-term strategy and growth ambitions.

“We remain fully committed to providing high quality and innovative fleet management and driver mobility services to our clients worldwide.”

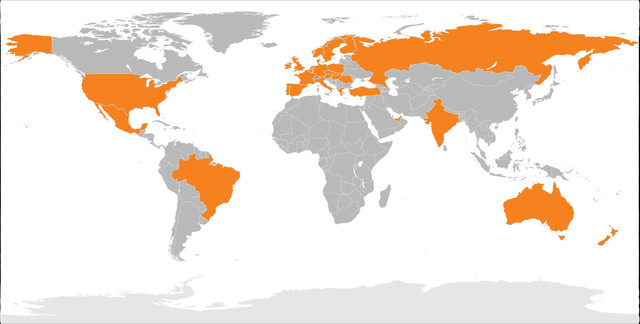

The world’s largest fleet management company, LeasePlan was founded in 1963 and operates in 32 countries worldwide and supports an overall network of 6,800 employees and 1.42 million vehicles.

It’s also the second biggest leasing company in the country and the third biggest buyer of new vehicles, meaning it’s unclear whether the handover will have any effect on sales figures in the UK.

The Dutch company was previously owned by Volkswagen and German bank Metzler, however as VW runs its own in-house leasing business, its 50 per cent stake in LeasePlan became harder to justify.

Off the back of the sale, Volkswagen is aiming to make an annual saving of around five billion euros by 2017, which it hopes will help to close profitability gaps with its rival manufacturers.

Volkswagen’s chief financial officer, Hans Dieter Pötsch, said: “With the expansion of our own fleet management activities at Volkswagen Financial Services, the time has, in our opinion, now come to hand LeasePlan over to new investors.”

The acquiring investors include Dutch pension fund manager PGGM, a subsidiary of the Abu Dhabi Investment Authority, alongside Goldman Sachs and private equity firm TDR Capital.

Subject to regulatory approval, in part due to the fact that LeasePlan holds a banking licence in the Netherlands, the deal is expected to officially close by the end of the year.