As it stands, the British car industry is undergoing its strongest period in years. Throughout 2015, a total 1,587,677 vehicles came off production lines in the UK, marking a 3.9 per cent rise over the previous year and the highest number in recent history.

Hold this up against the lingering effects of the recession and the all-time British record of 1.92 million cars, which was set as far back as 1972, and the industry appears to be doing extremely well for itself.

It’s a similar story in the US, where last year the sales of new vehicles cleared a peak last reached 15 years ago, with 17.5 million cars and light trucks finding new homes with American buyers and fuelling a 5.7 per cent increase over the previous year.

China, which has been undergoing a period of significant economic uncertainty as of late, still managed to reach a new high in terms of car sales, with 21.1 million passenger cars sold throughout 2015, marking a significant 7.3 per cent gain over 2014.

Currently, it appears as though the global car economy is in the healthiest state that it’s been certainly since the recession in the mid-2000s, but the question that industry heads and forecasters now need to ask is can it last?

Can the car sales bubble last?

For years, automakers feared the rising power of the millennial generation, which according to conventional wisdom, shunned the notion of car ownership. Unlike previous generations, which treated cars as status symbols, millennials supposedly didn’t want anything to do with buying a car, swapping supercar posters for Facebook posts and ride-sharing services.

That idea can actually be traced all the way back to a 2012 article by Derek Thompson and Jordan Weissman in the Atlantic. Titled ‘The Cheapest Generation’, the idea quickly caught on, fuelling fear on behalf of mortgage lenders and car salespeople alike as millennials would supposedly leave their entire industries in the dust.

Luckily for them, that idea largely seems to be now disproven. Millennials are buying cars, and given their status as the largest buying power in history, that’s good news for car manufacturers and dealerships. By 2014, millennials bought more cars in the US than Generation X’ers and it’s now estimated that in America at least, the generation is responsible for nearly a third of new car sales.

It even prompted Derek Thompson, one of the original authors of the Cheapest Generation article to do an about-face and admit in separate article in the Atlantic that the generation wasn’t so cheap after all, and that their demand for cars was only growing.

Sustainability, pollution and driverless cars

So far so good it seems, but even if buyer demand isn’t immediately a problem there’s plenty else out there that could be a serious cause for concern amongst manufacturers. According to a new report from Reinventing Parking, cars of today spend as much as 95 per cent of their time simply sitting still on a road, in a garage or in a driveway.

This raises all sorts of questions about wastage, sustainability and pollution, and even if millennials still have the same appetite for cars that previous generations had, new legislation, the rise of ride-sharing services and the advent of driverless cars could all throw a spanner into the works for the automotive economy.

For example, if a car spends the vast majority of its lifetime simply sitting pretty outside your house, might it make more economic sense for a cash-strapped owner to sell it and grab an Uber instead? Or, why grab an Uber when in a few years’ time you could feasibly hail a robotic driverless car to take you wherever you need to go, without having to pay for fuel, insurance, tax or the cost of the vehicle?

It’s these sorts of questions that manufacturers must now face and solutions must be found, either by augmenting the services that they already provide or by completely overhauling their business to keep up with the times.

In the US, as increased awareness of the risks of smoking and outsourced tobacco production to foreign countries caused tobacco crops to be less profitable for farmers, the farmers gave up some portion of their land to growing corn.

Alternative use of assets

Between their core tobacco business and money from the animal feed and ethanol industries for the corn, the farmers did well at a time when, if they had stayed producing solely tobacco, they might have floundered. Alternative use of assets is central to a growing number of industries, and could soon list the automotive industry among them.

Currently, the stages of car ownership that work to the benefit of both manufacturer and dealership start when the customer buys a new car, but typically ends once the car’s warranty expires. Once an owner has to pay hard cash to keep their car running, they’ll either sell up or find an independent mechanic that’s cheaper than a dealer-based repair shop.

The thing is that car manufacturers are in a much better position to either refurbish or to repair cars than local mechanics, given that their service departments have uniformly well-trained staff, an unlimited supply of factory-fresh parts and the ability to loan customers courtesy cars.

A well-built and well-maintained car is good for 100,000 miles or potentially even more if its owner keeps it in good nick, something which owners learned the hard way during the recession when new cars were less affordable than they are currently. Could repairing and refurbishing existing cars be the alternative use of assets to keep car manufacturers afloat in a future where sales figures slip?

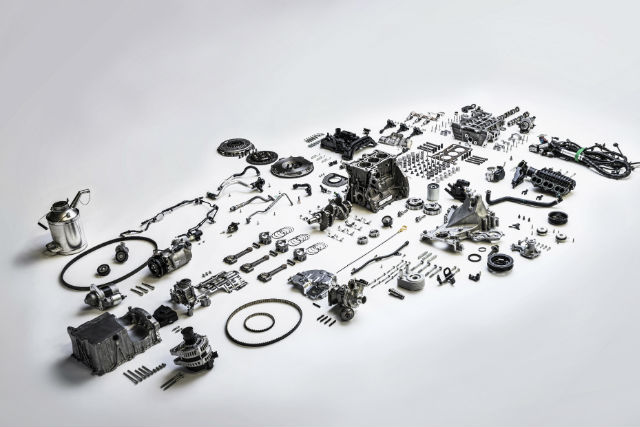

Spare parts and engine refurbs

Manufacturers are already in the business of selling their spare parts and often offering refurbished engines as well, and the maintenance of cars that are no longer new is a tremendously large and extremely profitable business.

For large companies like Ford, General Motors or Volkswagen, offering buyers the option to refresh their cars could bring in billions of pounds worth of revenue with only modest investment. With skilled mechanics and original factory parts, a four or five year-old car could be transformed into one that runs like a one year-old car with minimal work and minimal cost.

Of course, the main arguments against this are the effect that it would have on independent mechanics, used car sales and also the fact that any major car company that shifts focus onto refurbishing its older cars would take attention away from selling its brand new cars.

Still, while there are clearly plenty of people who want a new car, who can afford a new car and who will buy one whenever they please, there are still a significant number of car owners who would like to keep their current car in good shape for a while yet.

Buying power continuing to mature

A buyer who owns a car from Manufacturer X but can’t afford a new one from the same maker might instead be pushed to buy a similar, less expensive car from Manufacturer Y. But, a Manufacturer X driver who can have his car made good as new for less than the cost of any new car will always come back to Manufacturer X. Refurbishment packages could even be financed in the same way that new purchases are to spread the cost and to make it more appealing to cash-strapped motorists.

Of course, at present this isn’t really something that manufacturers specifically have to worry about, at least not judging by the latest sales figures, anyway. More people are buying more cars than they have in recent history, and if things stay the way they are that’ll only continue as the buying power of the millennial generation continues to mature.

But things are changing, and changing rapidly. Faced with a future where purchasing a new car just mightn’t make sense from a financial, environmental or cultural standpoint, it could just be that car manufacturers will have to go the way of the tobacco farmer.