The Chancellor of the Exchequer, George Osborne, has just announced this year’s summer budget. While only a small number of changes related to cars and motoring in general have been included, their effect on Britain’s motorists is going to be huge from 2017 onwards.

No more free Vehicle Excise Duty for petrol and diesel cars

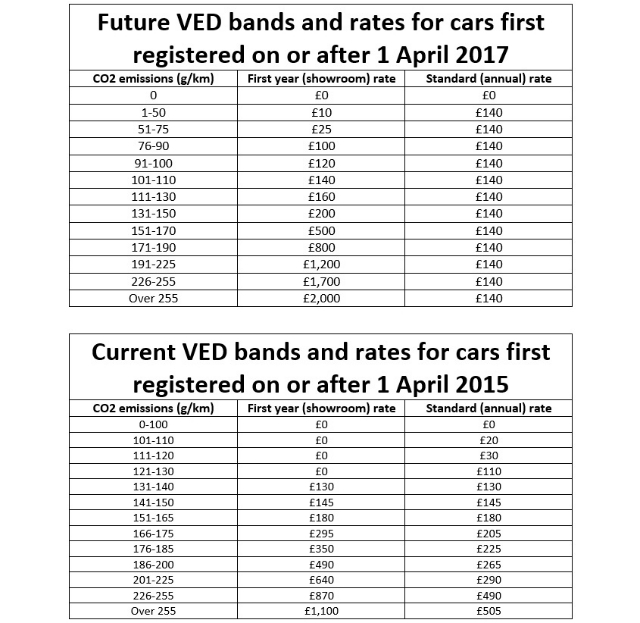

The biggest changes for motorists centre on Vehicle Excise Duty (VED), also known as road tax or car tax. As usual, the amount of VED you pay is determined by different bands based on the car’s CO2 emission output.

From 2017, new cars will be ruled by new VED bands which will see many more models paying tax than before. These new bands are broken down to three basic categories – ‘zero’, ‘standard’ and ‘premium’.

Up until now any car emitting less than 100g/km in CO2 benefitted from free VED. But under the new system, only cars that record 0g/km – something only electric cars achieve – will fall under the free of charge ‘zero’ category.

Petrol and diesel-run new cars (including hybrids) will be subject to the ‘standard’ category with a standard annual charge of £140. The first year ‘showroom’ rate will vary between £10 and £2,000 depending on the exact CO2 figure. According to Osborne, 95 per cent of new cars will fall under the ‘standard’ category.

Also from 2017, new cars with a list price of over £40,000 will pay a supplement of £310 per year on top of the standard rate, for five years. This particular rule will include all-electric luxury cars, like the Tesla Model S, which have previously been exempt from VED.

Explaining the motivations for the new VED bands, Osborne said: “Because so many new cars now fall into the low-carbon emission plans, by 2017 over three quarters of new cars will pay no VED at all in the first year. This isn’t sustainable and it isn’t fair.”

Osborne has also announced that when the changes are in place, the money raised through VED will now go into a new fund which will be used solely to improve Britain’s roads from 2020.

It has been made clear that because these new rules on VED bands only apply to new cars from 2017, no one will end up paying more tax on a vehicle they already own or buy before that year.

New and old VED bands tables compared

* For future VED bands - cars with a list price of over £40,000 when new pay a supplement of £310 per year on top of the standard rate, for five years.

Longer interval for first MOT, fuel duty remains frozen

Alongside the changes to VED, Osborne also revealed that he would consult on the current MOT system. Specifically, he’ll look to extend the age which cars and motorbikes require their first MOT test from three to four years. Osborne commented that the extended interval will save motorists around £100 a year.

It has also been confirmed that fuel duty will remain frozen at its current rate for the rest of the year.

Cost of car insurance increases – young drivers hit the hardest

From this November, the insurance premium tax is set to rise from six per cent to 9.5 per cent. This change affects all sorts of different types of insurance, including the type that covers cars.

Young drivers are dealt the biggest blow by this change. The price comparison website uSwitch.com has forecast that drivers aged between 17 and 22 will end up paying on average £1,247 for car insurance each year.