When it comes to investing in cars, opinion tends to be divided down two lines: either that every car is nothing but a sinkhole for you to pour your money into, or that every single remotely cool car will appreciate like crazy given enough time.

Sorry to burst any preconceptions, but both of these notions are, of course, rubbish. As we’ve detailed before, cars as a whole generally tend to be some of the worst investment opportunities you can take; in order to buy anything that will genuinely appreciate quickly and reliably, you’ll have to be pretty well off to begin with.

Still, there are a few ways that you can make money by investing in cars if you’re careful. Those last three words are probably the most important three in this entire article as, despite the old mantra of ‘no risk, no reward’, in order to make consistently sound financial decisions you have to account for and minimise all forms of risk wherever possible.

With that in mind, if you’re interested in making a healthy investment, the key to making money with an automotive purchase ultimately boils down to a few key snippets of common sense.

Buy cheap, sell fair

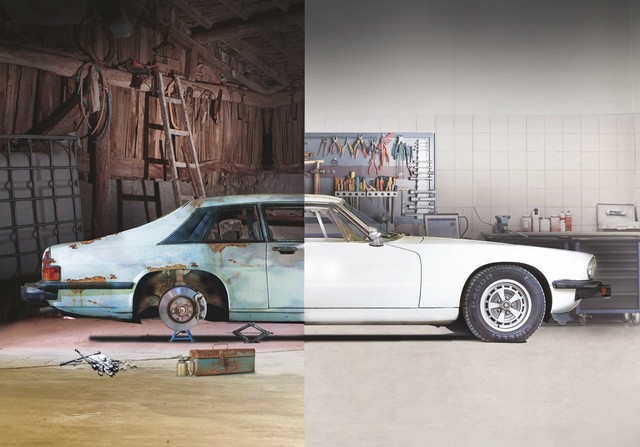

Wheeler Dealers and similar programmes often show a fast-paced life of pro car flippers, who take rusting heaps and turn them into showroom-condition vehicles, in the process racking up enough cash in a week to make a Premier League footballer blush.

The reality, even for the Wheeler Dealers team, is much more complex. Television crews spend months in advance researching their vehicles, while a crack team of in-house engineers are often used to restore the cars. You? You’re most likely on your own in this.

Still, according to Jalopnik’s resident buying expert Freddy ‘Tavarish’ Hernandez, if there’s anything that can be learned from this, it’s the three tried-and-tested processes for buying a car for profit. First, find a car in an emerging market, then buy it for less than its market value and finally sell it on for its market value.

Yes, riskier investments can return cash faster, but playing the long game is safer, Tavarish reckons, and when it’s your hard-earned money on the line, resisting the temptation to buy into a high-risk investment is key to ensuring you don’t bungle the whole thing.

Once you’ve identified the car you’re going to buy and found one priced under its market value, the plan then, aside from any repairs the car might need, is to simply sit and wait for the market to reach the level you want it to be at.

Even if the car is far from a museum-grade example and has a few minor problems here and there, ensuring that it’s a solid runner and pricing it accordingly can still make you money. Do be aware of current market values, however. If you could end up making more money by keeping the car an extra year or two, then it’s probably a good idea to do so, but keep your finger on the pulse of changing trends.

If you’re careful, you buy right, and you know when the right time to sell is, you could see a £3,000 beater turned into £6,000 or more; a higher return than many stocks within a much shorter time span.

Pick a partner

If you don’t have the money to fund an investment yourself, or you’re not quite comfortable splashing the cash on a bigger risk, finding a worthwhile and trustworthy partner to split the difference with can be a big help.

According to website The Penny Hoarder, your ideal partner will, naturally, have a bit of spare capital lying around, but more importantly they’ll be somebody that you can trust to make fair and sound financial decisions. Most people wouldn’t steal from you, but can you trust them not to make bad decisions on your behalf?

It also helps if they know at least as much about cars as you do, while being mechanically inclined will also be a big bonus, so the pair of you can assess accurately whether your investment is a total pile of rubbish or not.

Of course, any profits that you make by eventually selling the car will be split between you and your partner, but splitting the difference can further reduce your risks and increase the frequency and consistency of your investments.

Do bear in mind, however, that it’s worthwhile making out some sort of formal agreement, even if it’s just scrawling it on a piece of paper so you have some kind of proof in writing. It won’t provide much legal clout, but it can help things feel a bit more business-like and help prevent disagreements in the future.

Always buy used cars

Anybody who’s watched The Wolf of Wall Street will be aware of the ‘pump-and-dump’ scheme, where crooked companies will trick investors into buying as much worthless stock in a supposedly growing firm as they can, right before it plummets into the ground.

In a way, buying a new car – particularly on finance – can have the same effect. If you’re buying a car for your own personal use, then finance deals can be brilliant, but if you’re buying a car as an investment avoid them at all costs.

Essentially, you’ll be paying much more than the car’s depreciated cost, plus interest, Jalopnik says. At the end of the finance term you’ll be left with nothing to show for your investment other than an old car and a £30,000 hole in your pocket. Like the ‘pump-and-dump’ example, you’ll have poured all your resources into a car only for it to end up actively costing you money in the long run.

Barring the most extreme examples, every single car depreciates. As a result, to get any sort of potential return with a traditional ‘buy low, sell high’ method, your best and least risky option is to buy a used car right when it seems like the market has all but forgotten it.

Even though this might seem riskier than buying a car that’s still in demand, the upswing is that if you buy it right at the bottom of its depreciation curve, your costs won’t be too high. As with anything, however, good research is always key to a good plan, so make sure you know exactly what you’re buying.

Know how to pick the right car

It’s an old saying, but ‘you have to spend money to make money’ is ultimately true. Outside of getting a well-paid job, money is only ever made when you buy something, so picking a winner is the most important part of the process and the reason why research is so vital.

Of course, the downside is that if you pick a lemon then you may as well have poured your money down the toilet, but if you know your stuff then buying cars is nowhere near as risky as picking random stocks in companies.

Although it has its similarities with gambling, the difference is that if you do your research thoroughly enough, you can account for and negate nearly all risk before you even think about making a withdrawal from your bank account.

The best way of predicting whether a car will go up in value is generally based around three golden criteria, Jalopnik says: whether the car was desirable when new, whether it’s iconic or notable in any way, or if it has depreciated to the point where it’s been all but forgotten about.

So what are the market segments that budding investors should pay particular attention to? Currently, any exotic sports or GT car that’s driver-focused and comes with a manual gearbox is rising in value, as a small but vocal market vacuum has opened up thanks to many high-end manufacturers now omitting manual gearboxes.

Some prime examples would include the manual versions of cars like the Ferrari F430 or Aston Martin DBS, but for more realistically-priced options there are plenty of BMW M cars and RS-badged Audis, though waiting for the market to peak might take a while longer.

Learn to use a wrench

One of the best ways to ensure you make a profit flipping cars is to buy yourself a set of spanners and learn how to use them, but learning to specialise in your chosen car will put you at an advantage.

Learning how to fix cars in general will always come handy, but if you learn to specialise in, for example, Volkswagen Beetles, you’ll not only be able to make better judgements about the cars themselves, but you can dramatically reduce your outgoing costs.

Instead of paying a mechanic to fix the cars for you, learning to rework and restore your particular car could save you hundreds if not thousands of pounds, reducing the amount of money you put into your investment, lessening risks and maximising profits.

If you’ve learned everything there is to know about wrenching Beetles from a previous successful sale, then you can capitalise on it and increase your chances of success by doing it again and again. Even if you have a cursory knowledge of how to replace lightbulbs or change out radio systems, this can save you quite a fair amount of money at the garage.

Don’t worry about ‘market bubbles’

Particularly when it comes to the housing market, ‘bubble’ is a term that gets batted around a lot. In simplest terms, it’s a phrase used to illustrate what happens when a rapidly-expanding market reaches saturation point and implodes.

While buying things on credit with cheap loans certainly is a bubble that’ll pop sooner or later, but paying cold, hard cash for an investment vehicle luckily has none of the same trouble, Jalopnik’s Tavarish states, mostly because cars are universally enjoyed and have the built-in ability to move anywhere.

Even if the UK falls upon hard times, that near-mint Datsun 240Z will likely be snapped up fairly quickly by someone in another country who’ll still pay out the nose for it. Of course, the more iconic the car the more money it’ll command, but there’s still room for the Average Joe.

While some high-end markets are a bit over-saturated, playing your cards right and getting a more affordable modern classic will rarely mean that you’ll fall victim to any sort of automotive economic collapse, meaning that relatively regular cars are essentially bubble-proof.

Know what you’re getting into

Though these rules will mostly steer you right, it’s worth realising that particularly in investments, nothing is ever certain. As a result, you should only pursue it if you’re 100 per cent alright with occasionally getting in over your head.

Despite trying to account for every risk, things do sometimes go wrong and repair costs in particular can often cost more than you’d originally thought. Still, bear in mind that problems with your car can be solved a lot more easily than problems with Wall Street, so it’s all swings and roundabouts, really.

Accept the fact that it will hit your bank account before it rewards it, accept the risks and accept the fact that you’ll have to pour a considerable amount of time and energy into it, and investing in cars can be incredibly rewarding.

Note, of course, that it can be. Still, at the end of the day, you can’t do burnouts with a cash ISA.